Now Reading: Nigeria’s Soaring Rent Crisis: VAT Removal ‘Won’t Reduce Housing Costs’, Real Estate Experts Warn

-

01

Nigeria’s Soaring Rent Crisis: VAT Removal ‘Won’t Reduce Housing Costs’, Real Estate Experts Warn

Nigeria’s Soaring Rent Crisis: VAT Removal ‘Won’t Reduce Housing Costs’, Real Estate Experts Warn

Housing crisis in Nigeria deepens as stakeholders say cement prices, weak regulation and mortgage gaps — not VAT — are driving record rent increases

Real estate stakeholders have dismissed suggestions that removing Value Added Tax (VAT) on land and rent will ease Nigeria’s spiralling housing costs, arguing that the real pressure points lie in soaring building material prices and weak housing regulation.

The debate follows clarification by Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, who stated that land, buildings and rent are already exempt from VAT under the Nigeria Tax Act currently being implemented.

His comments came amid widespread reports claiming the new tax law had introduced a 25% levy on building materials — a claim he rejected, insisting the reforms were meant to reduce the burden on tenants.

Rent Prices Double in Major Nigerian Cities

Despite that reassurance, property experts say tenants across Abuja, Lagos, Kano, Enugu and Port Harcourt continue to face unprecedented rent hikes.

In parts of Abuja — including Dawaki, Jabi, Jahi, Kubwa, Dutse and Nyanya — annual rent for a one-bedroom apartment has jumped by more than 100%, rising from between ₦500,000–₦1m to as high as ₦1.5m–₦2m.

For many Nigerians earning the ₦70,000 minimum wage, yearly rent now exceeds their total annual income.

‘Cement Price Is the Real Problem’

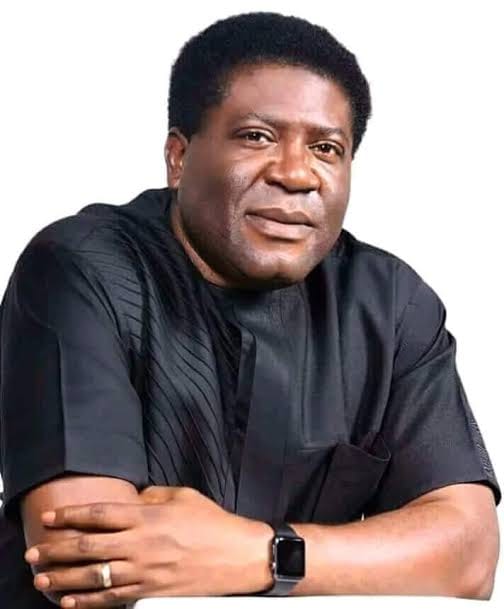

Former President of the Real Estate Developers Association of Nigeria, Aliyu Wamakko, said the focus on VAT is misplaced.

“Land already has VAT removed. The real issue is cement,” he said.

According to him, cement now sells for over ₦10,700 per 50kg bag in the open market, with factory prices hovering around ₦10,500.

He warned that growing demand — particularly from government road construction projects — is pushing prices even higher, inevitably feeding into housing costs.

“When the cost of cement rises, everything connected to construction rises — whether it’s rent or the sale price of a house,” he explained.

Wamakko added that Nigeria’s housing deficit — estimated at over 14.9 million units — remains concentrated in major urban centres such as Abuja, Lagos, Kano and Port Harcourt.

“As long as building materials keep rising, rent will not drop,” he said. “If the government truly wants to renew hope in the real estate sector, it must address cement prices.”

Weak Oversight and Mortgage Gaps Blamed

Hakeem Suleiman, President of the Association of Abuja Tenants, pointed to a lack of effective housing regulation and limited access to mortgages as deeper structural problems.

He said landlords and property managers frequently raise rent without improving facilities or considering tenants’ economic realities.

“You rent a self-contained apartment for ₦250,000 and suddenly it jumps to ₦1m without any added value. There is no effective control mechanism,” he said.

Suleiman argued that accessible mortgage systems would allow more Nigerians to transition from renting to home ownership, easing pressure on the rental market.

“Government regulators must act. Nigerians are bleeding under these costs,” he added.

Inflation Falls, But Living Costs Remain High

The concerns come even as Nigeria’s headline inflation rate fell to 15.10% in January 2026, according to the National Bureau of Statistics.

However, many households say the easing inflation figures have not translated into lower living expenses — particularly in housing, which remains one of the biggest financial burdens for urban residents.

For now, stakeholders agree on one thing: removing VAT alone will not solve Nigeria’s rent crisis unless deeper structural issues in construction costs, housing supply and mortgage accessibility are addressed.